Isn’t it time to help you enhance to some other household? ily is growing while you would like more space. Or you happen to be best off financially and able to move ahead away from their starter household. Possibly you happen to be merely ready for a change. Essentially, it seems sensible to offer your current house first and make use of the gains to cover advance payment of the brand new home, however, this isn’t always easy. Promoting a home can take months. This means one offers build could be contingent on the product sales of the most recent domestic, which is less inclined to be acknowledged by a provider, otherwise you are going to need to wait while making one render anyway. Fortunately, it is not your only choice.

If you are on the market to offer your family and you may pick a new but never have enough money for the dollars to possess an excellent downpayment, you could potentially choose for a connection mortgage otherwise a zero-down-percentage home loan. Sometimes choice can get you into the new house smaller, however, which is ideal for your situation? Which are the differences between them? How can you like? Continue reading to find out.

What’s a connection financing?

A link loan brings an effective way to go from one to house to some other till the very first home possess marketed. If you’re bridge finance can also be used in different portion, they are primarily useful for home. This type of loans also are labeled as interim and you may/otherwise gap investment and they are both entitled move finance. It allow it to be a resident to make use of the latest equity within their current the home of place a down payment to your a new family while they are nonetheless looking forward to the present day where you can find offer. Solarity link finance bring capital for the doing 90% of one’s appraised worth of your existing family.

Exactly why are a bridge financing distinct from a mortgage? Primarily, link financing is small-title money. He could be supposed to defense money to possess a particular, transformation big date, whereas mortgages typically have attacks of up to three decades. Link financing past until the faster label is more than, commonly per year, or before homeowner obtains a lot more long lasting financial support like attempting to sell the current the place to find pay the link mortgage. In the meantime, new debtor makes interest-simply repayments to keep the borrowed funds when you look at the an excellent condition.

Whom benefits from a bridge mortgage?

First of all, it assists if the people have already discovered the house it want it and you will go on to. Once they hold back until the latest household carries, they s you will definitely already go away.

While doing so, a link loan does mean the homeowners don’t need to rush to offer their newest family. This may allow them to perform even more work with the home to increase their worthy of and gives all of them time for you ensure that they’ve been recognizing the best selection.

By providing extra time, link funds help make that it transformation period easier. Swinging from just one home to an alternative will likely be enjoyable, maybe not tiring.

Solarity bridge financing in addition to allow for even more convenience. After you close in your new home, you might close to the bridge loan meanwhile.

Thinking in the event that a link financing is the correct call for you? Please reach out to Solarity’s Home loan Instructions. We will check your disease and you will discuss the options. Our company is happy to respond to any questions you’ve got about any of it style of from home loan.

It actually was after simple you to potential property owners lay an effective 20% deposit with the property, but minutes enjoys changed. Today, there are many additional options which make homeownership smoother and you will far more doable, whether you are purchasing your very first household otherwise your own fifth. Also lower-down-payment mortgage loans, a zero-down-commission mortgage is a well-known options. The main benefit of this is during the malfunction: the fresh downpayment number try 0%. Incase we need to pick a different house but do not have sufficient dollars for a down payment, this could be an effective way to take action.

Fundamentally, you keep up the totally new financing up to your house carries, as well as in the fresh new interim, you’re taking aside the second separate financial-in cases like this, a zero-down-percentage mortgage-purchasing a moment household. You make full money to the both finance until the earliest home deal while pay-off the loan.

If you find yourself possibly variety of financing gets your a unique family ahead of your dated family keeps offered without the need for a great contingent promote, the options aren’t equivalent. Let us have a look at the chief variations in terms to purchasing you to brand new home.

First of all, if you are a no-down-percentage home loan doesn’t require a deposit, a bridge financing will provide you with a down payment by the leverage the latest equity you built up on the newest home. Merely with a down payment can mean better rates of interest and you can conditions for the the brand new home loan. It can also suggest the essential difference between being forced www.cashadvancecompass.com/installment-loans-ok/castle to pay for PMI or otherwise not on your own no-off mortgage.

And, taking out fully the next home loan, actually in the place of a down-payment, mode you have one or two mortgage payments you should generate during the complete every month. With a connection loan, you only pay the mortgage appeal, definition your financial weight each month is a bit less.

For the majority homebuyers, a bridge financing is the better option, but it is vital that you correspond with a specialist one which just disperse submit.

Just how Solarity helps you like

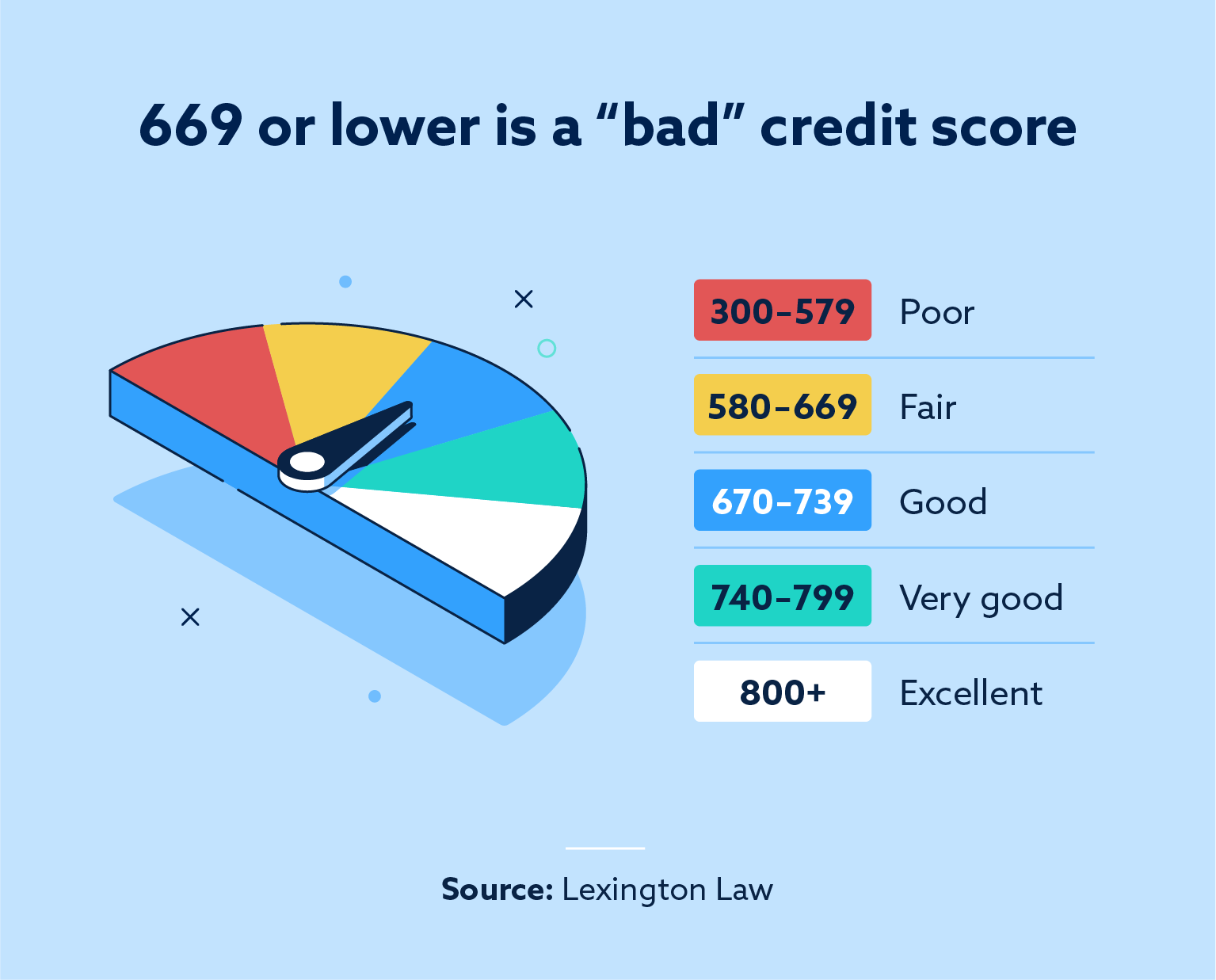

After you borrow with Solarity Borrowing Relationship, you are in the hands away from masters. If you’re considering your property mortgage choices, get in touch with all of us. Our very own experts will over the important info, together with money and you may credit history. As soon as we rating an extensive notion of a situation, we’ll decide which in our home loans may benefit you the very.

Discover plenty additional info throughout the link money, zero-down-fee mortgage loans or other financial choices with the Solarity Borrowing from the bank Union’s web site. You will find beneficial gadgets and you may guidance, as well as home financing calculator. No matter which choice is right for you, we are going to make sure the financial and you will homebuying processes was given that as simple possible. Pertain online and start today. We look ahead to assisting you discover your house.

The expert Mortgage Courses is actually here to help

You’ll find nothing our house Financing Courses love more watching players move into their dream property. Our company is here to store one thing as facile as it is possible (in addition to a completely on line yet custom processes)!