Identical to funding a house having any other type off mortgage, to acquire a foreclosure which have an enthusiastic FHA loan has also the upsides and you can drawbacks.

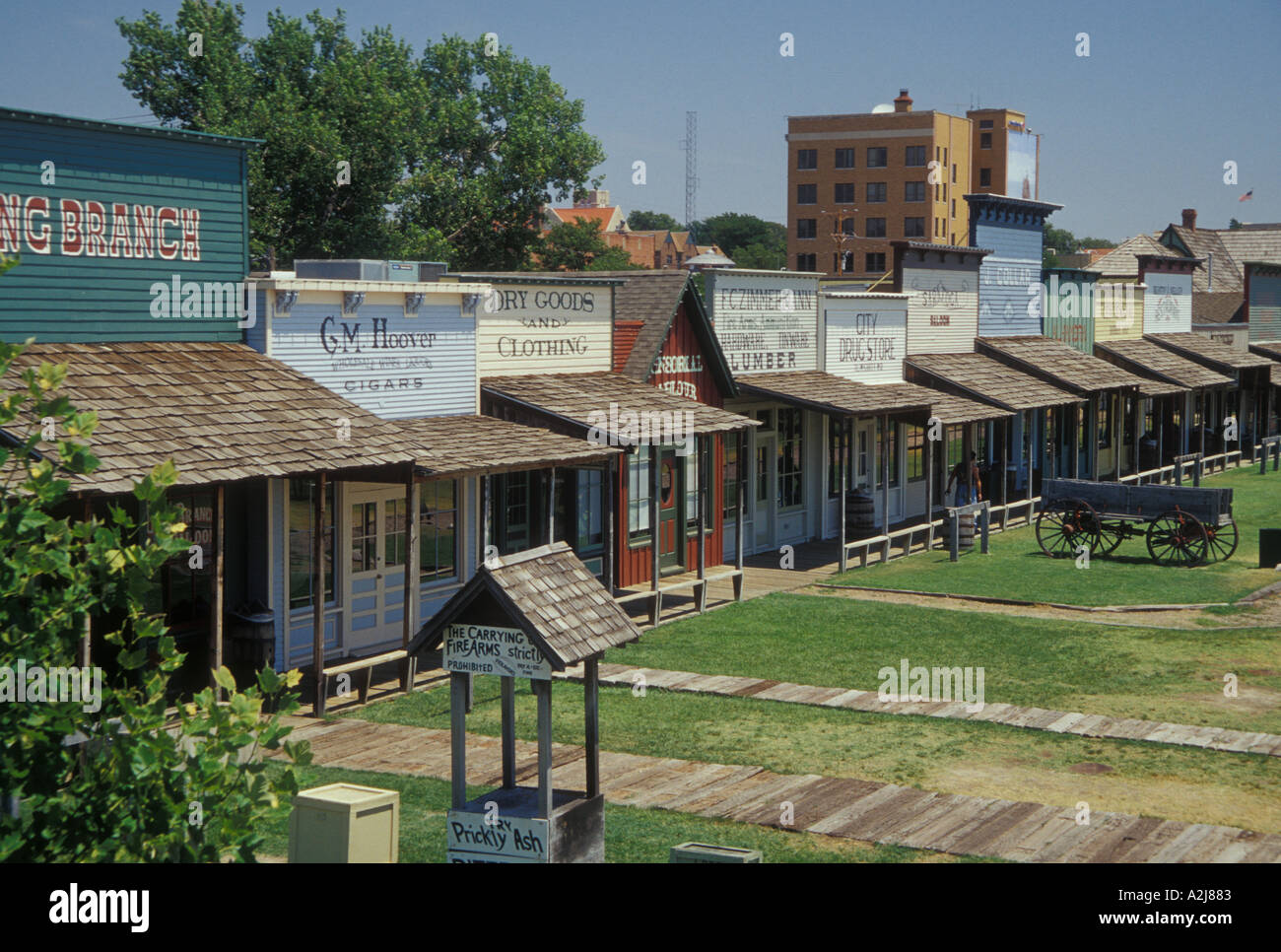

Just in case the newest foreclosed property happens unsold at public auction, the lender becomes the owner of the property in lieu of a keen individual

- Low-down payment. When you yourself have a credit score with a minimum of 580, an FHA mortgage just demands a great 3.5% off – which is much lower compared to the antique 20% down required by installment loans in Jacksonville VT with bad credit many loan providers. This makes it easier just in case you are interested to buy a great foreclosed family without a lot of money secured.

- Quicker strict certificates. As stated more than, FHA money have an even more easy credit rating and downpayment standards versus old-fashioned mortgage loans. This makes it a beneficial selection for consumers whom may not if you don’t be considered.

- Ideal sales. Other advantageous asset of to get a foreclosure with an FHA mortgage is actually that foreclosure are usually priced less than similar virginia homes in identical areabined towards the reduced-rate of interest and you can low-down fee conditions getting FHA loans, this may will let you secure a good deal to the a good domestic which can if not end up being exterior your budget.

Of course brand new foreclosed possessions goes unsold from the public auction, the financial institution becomes who owns the home instead of an enthusiastic individual

- Must meet FHA possessions requirements. When you buy a property foreclosure which have a keen FHA loan, you nonetheless still need to satisfy FHA possessions conditions. That is hard should your house is inside the poor reputation or means fixes, particularly if the assets enjoys faults and you will damage who would connect with the protection, protection, otherwise soundness of the property.

- Race with other people. As the foreclosed land are offered on the cheap, most people are trying generate income on the money by the turning such services having a future product sales. If these types of potential buyers would like to choose the foreclosed household into the bucks, financing it with an enthusiastic FHA loan you’ll put you within a great drawback. Mainly because a finances promote boasts a lot fewer contingencies minimizing exposure, and you will manufacturers usually prefer they more than a funded render.

- Foreclosed attributes can be purchased given that-are. Foreclosed characteristics are offered as-are, and thus people repairs was your responsibility and there’s usually zero room getting discussion. Therefore if anything big happens to your property immediately after closing, you’ll have to pay for the newest solutions oneself. Definitely get that it into consideration ahead of time. Fix will cost you accumulates rapidly should your possessions isn’t for the good shape.

A financial-had home is fundamentally property which was foreclosed with the by a financial institution. Which family will likely then sit on the fresh bank’s courses until it is offered.

The expression short marketing, known as a great pre-property foreclosure deals, happens when property comes for less than the remaining equilibrium on the home financing. Its an alternative to foreclosures that allows new debtor to offer their home and you can pay off their personal debt whenever you are avoiding the wreck to their credit score that include foreclosures.

Because the brief marketing attributes happen to be from the a low price, you’ll save potentially conserve way more profit brand new a lot of time title towards the FHA loan’s low interest rates and you will low-down payment.

Assuming the newest foreclosed possessions goes unsold from the market, the lending company will get who owns the property in place of a keen private

- Inhabit the property. Make sure to make use of the FHA mortgage to buy property you love. Brand new HUD demands borrowers while making their new property their no. 1 house.

Including on the web postings, look for a realtor exactly who focuses on foreclosed belongings. This can be particularly important getting earliest-day foreclosed consumers, since you may not know plenty once you see one to, your representative often.