Within this blog post

Understanding the some other mortgage solutions can significantly effect the financial approach, especially for people looking to accept in the rural or suburban elements. Less than Point 502 Unmarried-Friends Outlying Casing Financing, there are two type of USDA fund: the fresh new USDA head loan additionally the USDA secured mortgage.

If you are each other endeavor to enhance homeownership inside the quicker heavily inhabited parts, it focus on various other monetary products and provide distinct professionals and you will conditions. Prior to dive on these USDA loans, its important to understand what he’s as well as how capable work for some body and you can family thinking of buying assets inside the outlying components.

The united states Agencies out of Farming (USDA) developed each other direct and you will guaranteed financing software to provide affordable homeownership ventures whenever you are producing financial development in rural organizations. One another loan sizes endeavor to assist applicants just who may well not be considered having old-fashioned fund because of money limitations or any other financial facts, causing them to good for people otherwise family which have changing otherwise non-old-fashioned income supplies.

Since you talk about the newest similarities and you can differences between such loan options, understand that Neighbors Bank simply even offers USDA protected funds. We do not loans USDA head financing nor carry out most other individual lenders.

Small Activities:

- There are two main different kinds of USDA money: the head mortgage and protected loan.

- Brand new USDA direct financing is just available truly through the USDA and has certain criteria, and also make qualifying more difficult.

- Brand new USDA guaranteed mortgage is just readily available owing to private loan providers, such as for instance Neighbor’s Bank, but it’s nonetheless authorities-backed.

- Both mortgage systems possess distinctive line of pros and cons, but one another lead and you will secured financing offer potential homebuyers in outlying areas a unique homebuying options. Read more to ascertain which suits you!

What exactly is an excellent USDA lead loan?

USDA lead money, labeled as Area 502 head funds, are merely offered individually from the United states Department regarding Farming (USDA). Borrowers need to make no more than fifty-80% of the area’s average income, which makes qualifying because of it financing a small difficult if you try not to meet it standards. Within borrowing from the bank circumstance, this new USDA functions as the financial institution and provides the amount of money called for to find the house.

What exactly is a beneficial USDA secured loan?

USDA protected finance, known as Section 502 guaranteed money, arrive thanks to individual lenders, particularly Neighbors Financial, but they are still supported by the new USDA so you can decrease potential chance for individual lenders. People don’t create over 115% of your own area’s average money to-be qualified. For the bigger eligibility, so it USDA loan choice is tend to much more beneficial to help you consumers and you will thus more popular than just USDA head funds.

Evaluating USDA Head and Protected Money

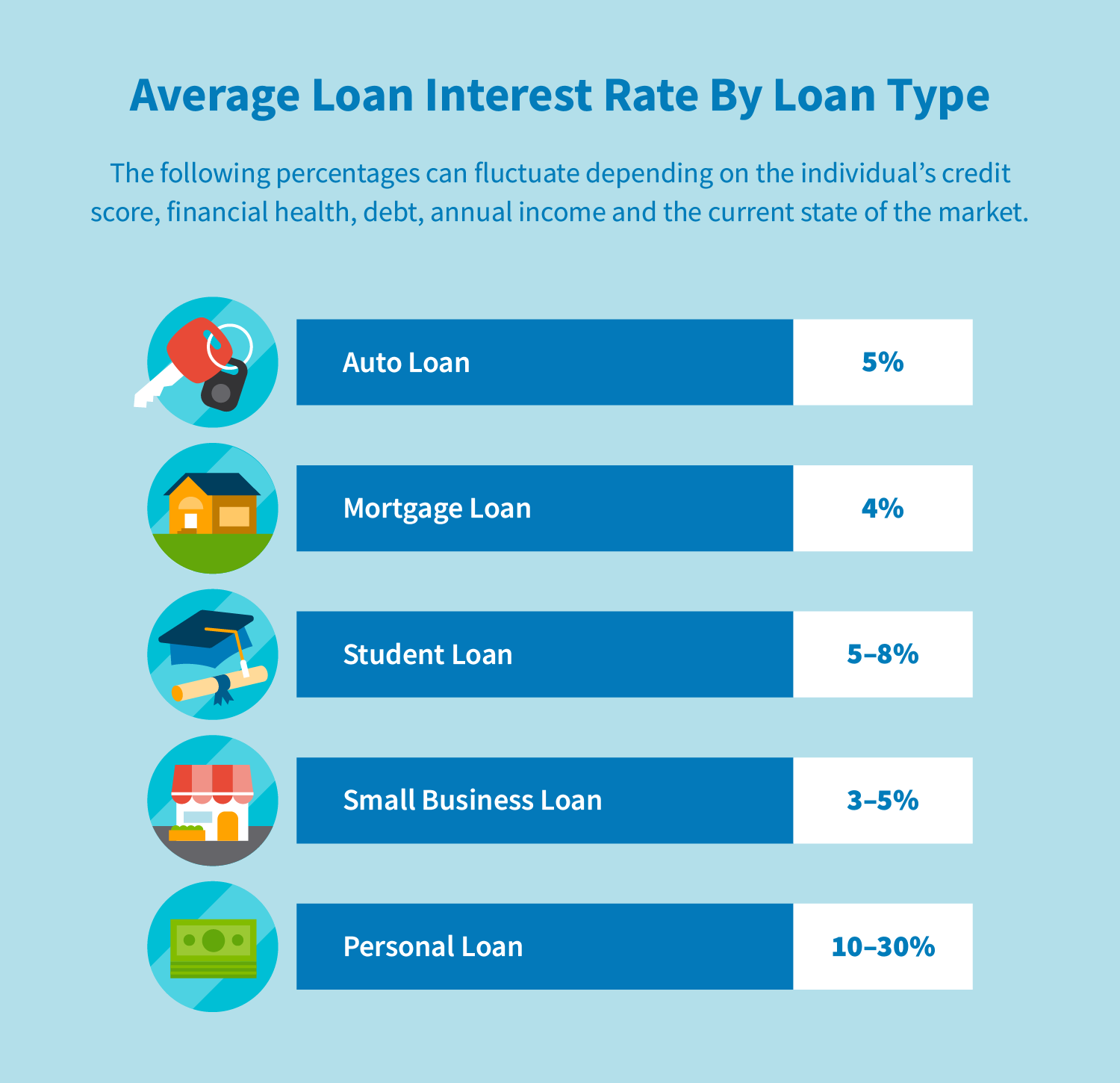

While one another direct and you may secured USDA financing supply the great things about good USDA-supported mortgage, including $0 down repayments and lower interest rates, there are some key distinctions between them. Having an easy research of your USDA direct versus. secured financing, check out the after the aspects:

Money Factors and you will Assets Standards

For the majority of family members, the flexibleness of your own guaranteed mortgage is tempting whenever they enjoys higher earnings profile otherwise want a bigger household. In contrast, direct money was considerably better if you’re looking getting a larger financial help and you will meet the more strict earnings standards.

One another mortgage versions require property is structurally voice, functionally sufficient, plus a good resolve. That it means that residential property funded less than these software is actually as well as reliable for long-label home.

Charges and you may Settlement costs

One another money accommodate moving closing costs to your amount borrowed and potential vendor contributions. Direct Money none of them financial insurance policies, resulting in lower monthly installments. Yet not, secured funds involve an initial make certain percentage and you may a yearly advanced, just like most other reasonable-down-payment software.

Application Process for USDA Head vs. Protected Financing

Applying for a USDA direct loan tends to be a small different out of a beneficial USDA secured financing once the lead funds are just offered from the USDA, thus why don’t we look closer in the several app process.

USDA Head Application for the loan

In lieu of USDA guaranteed loans, there is no way to begin with this new USDA direct loan application process on the web. Applicants need submit an application for an effective USDA direct financing through its local Rural Creativity (RD) Place of work. Such masters have a tendency to guide you from app process and help you find out if an effective USDA direct loan ‘s the correct fit for your. From there, the fresh USDA really works personally toward borrower regarding mortgage procedure.

USDA Protected Application for the loan

With regards to USDA secured money, individuals can be fill out their application to a great USDA bank, instance Neighbors Financial. These lenders work on the newest USDA about mortgage processes but have the effect of completing the borrowed funds software and underwriting techniques.

Positives and negatives off USDA Protected Funds

Since the lead financing are available personally from USDA, Neighbors Lender only also provides USDA protected loans. If you are searching to work well with a loan provider through your homebuying trip, see less than from the positives and negatives of employing a good USDA secured when comparing to an effective USDA direct loan:

The conclusion

In conclusion, each other version of USDA fund offer potential real estate buyers during the outlying portion yet another homebuying chance. Because of the https://paydayloanalabama.com/oak-hill/ understanding the distinctions and you will parallels ranging from both USDA financing models, you’ll find one that’s most effective for you!